In business, every decision comes down to results. Whether it’s launching a new marketing campaign, purchasing equipment, or hiring staff, leaders want to know if the investment will generate value. This is where ROI, or Return on Investment, becomes essential.

ROI is one of the most commonly used financial metrics when evaluating performance. It provides a simple yet powerful way to measure profitability and efficiency. Companies, investors, and marketers all rely on ROI to make informed choices and optimize resources.

In this guide, we will explore ROI in depth, from its meaning to practical calculations, examples, and advanced applications. By the end, you’ll not only understand ROI but also learn how to apply it effectively to your own decisions.

What is ROI?

Return on Investment (ROI) is a financial metric that measures the profitability of an investment compared to its cost. It indicates how much benefit, or return, an individual or organization gains relative to the money put in.

At its core, ROI answers a simple question: “Was this investment worth it?” Whether calculating returns from stock investments, advertising spend, or operational upgrades, ROI offers a straightforward way to evaluate success.

ROI is usually expressed as a percentage. The higher the percentage, the greater the return compared to the cost. An ROI of 100% means the investment doubled its cost, while an ROI below 0% indicates a loss.

Why ROI Matters

ROI matters because it bridges the gap between decision-making and measurable outcomes. Leaders may set lofty goals, but ROI shows whether actions translate into financial benefits.

Businesses use ROI to optimize marketing campaigns, streamline budgets, and choose between competing projects. Investors use it to compare different assets, while entrepreneurs apply it before expanding operations.

Without ROI, decisions rely on intuition or guesswork. With ROI, performance becomes quantifiable, making strategies easier to justify and defend

ROI Across Different Contexts

In Business, used to measure the success of projects, purchases, or employee training initiatives.

In Marketing, ROI evaluates campaigns by comparing ad spend to generated revenue.

In Finance, Investors calculate ROI to compare different assets like stocks or bonds.

In Technology, ROI determines if digital tools or automation save more than they cost.

This versatility makes ROI a universal tool across industries.

How to Calculate ROI

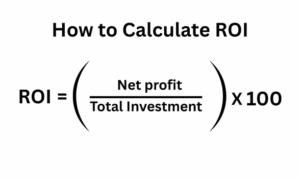

The most basic ROI formula is:

ROI = (Net Profit ÷ Investment Cost) × 100

This formula calculates the percentage return on an investment. For example, if you invest $1,000 and gain $1,200 back, your ROI would be:

[(1,200 – 1,000) ÷ 1,000] × 100 = 20%.

This indicates your investment returned a 20% profit.

Breaking Down the Formula

The ROI formula depends on two elements:

Net Profit (Gain from Investment – Cost of Investment): The amount you make after subtracting expenses.

Investment Cost: The total resources spent, such as money, time, or assets.

By comparing these two numbers, ROI shows whether resources are being used efficiently.

Variations of ROI

Different industries may calculate ROI slightly differently to suit their needs.

Marketing ROI: (Revenue from Campaign – Marketing Cost) ÷ Marketing Cost × 100

E-commerce ROI: (Sales from Ads – Cost of Ads) ÷ Ad Spend × 100

Real Estate ROI: (Rental Income – Expense) ÷ Property Value × 100

Stock Market ROI: (Final Value – Initial Value + Dividends) ÷ Initial Investment × 100

These variations give a more accurate measure depending on what’s being assessed.

ROI Vs. Other Metrics

It’s important not to confuse ROI with other financial indicators.

ROE (Return on Equity): Focuses on returns relative to shareholder equity.

ROA (Return on Assets): Measures profitability relative to total assets.

IRR (Internal Rate of Return): Evaluates long-term investment profitability, considering cash flows over time.

Unlike these, ROI is broad and simple, which is why it’s widely used.

ROI Example

To fully understand ROI, let’s look at practical scenarios.

Example 1: Business Project ROI

A company spends $20,000 to upgrade its IT systems. After one year, the upgrade has improved efficiency, reducing expenses by $8,000 and increasing revenue by $10,000.

Gain: $18,000

Cost: $20,000

ROI = (18,000 ÷ 20,000) × 100 = 90%

This shows the project nearly doubled the value of the investment.

Example 2: Marketing Campaign ROI

A retail store invests $5,000 in Facebook Ads. The campaign generates $15,000 in sales.

Gain: $10,000 ($15,000 – $5,000)

Cost: $5,000

ROI = (10,000 ÷ 5,000) × 100 = 200%

This means every $1 spent generated $3 in return.

Example 3: Personal Investment ROI

You purchase stock worth $2,500. A year later, you sell it for $3,000, and it also paid $100 in dividends.

Gain: $600

Cost: $2,500

ROI = (600 ÷ 2,500) × 100 = 24%

This example highlights how ROI captures the total return, not just price appreciation.

Factors That Influence ROI

ROI is not just about numbers—it depends on factors that can make calculations more complex.

Timeframe: A 10% return in a month is very different from 10% over five years.

Inflation: Over time, inflation lowers the real value of money, impacting ROI.

Hidden Costs: Taxes, fees, and maintenance costs often reduce actual returns.

Market Volatility: Changes in demand, pricing, or the economy affect the real value of ROI.

Understanding these factors ensures ROI results are realistic, not misleading.

Limitations of ROI

While ROI is a valuable tool, it is not perfect.

Does not consider time: ROI alone cannot measure how quickly returns occur.

Can be manipulated: Choosing what costs and returns to include can distort results.

Ignores risk: Two investments with the same ROI may have very different risk levels.

Not suitable for long-term projects: Complex ventures require time-sensitive metrics.

That’s why ROI should be combined with other performance indicators for a balanced view.

How Businesses Improve ROI

Organizations across industries apply several strategies to boost ROI.

Optimizing Marketing Spend: Using data analytics, businesses allocate budgets to top-performing channels.

Automation & Technology: Digital tools automate routine processes, saving costs.

Customer Retention: It costs five times more to acquire new customers than to retain existing ones, so improving loyalty enhances ROI.

Employee Training: Skilled employees deliver better performance and reduce inefficiencies.

By focusing on process improvements, companies gain higher returns without necessarily increasing spending.

Advanced ROI Metrics

For long-term insights, businesses often use advanced ROI models.

Social ROI: Measures non-financial value, such as brand reputation or customer satisfaction.

Economic Value Added (EVA): Evaluates true economic profit after accounting for capital cost.

Lifetime Value (LTV): Compares customer lifetime value to acquisition costs.

Return on Marketing Investment (ROMI): A Specialized version of ROI for marketing analysis.

These advanced metrics provide a clearer picture of sustainability and growth potential.

Conclusion

ROI is one of the most important financial metrics for businesses, investors, and decision-makers. It simplifies evaluation by comparing returns to costs, making it easier to determine whether an initiative is worth pursuing.

From basic ROI formulas to industry-specific applications and advanced models, ROI helps leaders allocate resources wisely. While it has limitations, when combined with other financial indicators, ROI creates a clearer picture of success.

The bottom line: If you can measure ROI, you can control and improve it. And in business, what gets measured is what gets managed.